The UK has recently 'created' £325bn.

This is an amazing fact. Quantitative easing is just the printing of money - our money - more money than you can imagine - really!

Now, the BoE (Bank of England) says that this money does not add to the debt as it is placed on the BoE's balance sheet and will at some time in the future be pulled back out of circulation. Ok, so just when will the BoE be able to take it back? With the current overall debt continuing to grow year on year it will be impossible to do this for the foreseeble future. So, in effect the BoE has created new money, effectively just diluting the value of the pound - but they have done it in such a way that it just inflates share prices rather than creating investment - Daft! CST

To put this in context, this amount of money would pay for all education in the UK for nearly four years or three years running UK's Health Service.

CST attempts to put forward creative ideas for moving Britain forward. You may not agree with them all - but if we had invested this amount of money in these types of investments - Britain could already be looking forward to a prosperous future for our children.

But instead - we simply gave it away to the banks - for them to squander on the very same 'products' that got us into the mire in the first place!

Ask yourself - why has no one in the media or government suggested that this money could have been 'invested' in the UK and not just given away to the banks? Is this not the biggest blunder of all time? Remember it is OUR money, creating it means that your pensions, your savings, your future is reduced in proportion. Why has our government just thrown it away without even a 'by your leave'? - CST

How would it work? Easy, we use the current infrastructure of the banks (we already own several) and create long term plans to invest the money in key schemes such as the 25 year planning for energy & transport. The money would fund UK research, UK businesses and project management to carry through the plans. All of these would be outside government and kept within the UK (If this breaks the EU's rules, then they can lump it as its not real money anyway!)

The western world is clearly doomed. This is the message from every media source and political spokesperson.

So a thousand or so years of successful technologically based improvement in our living and working conditions has just stopped dead and is going to reverse. Or is it perhaps that we are looking through the wrong end of the telescope?

Let us take a stand back view of where we are, and, perhaps this will help us see the way forward?

What we know:-

The world has created ongoing improvement by leveraging technologies for many, many centuries. The main improvements in the last thousand years have been due to leveraging:-

And also:-

All relapses in this progress have been due to political or religious dogma

This is a long term trend. It is unlikely to end today or tomorrow.

Reliance on old methods and current economic performance just won't work any longer - your money, savings and pensions have already been spent.

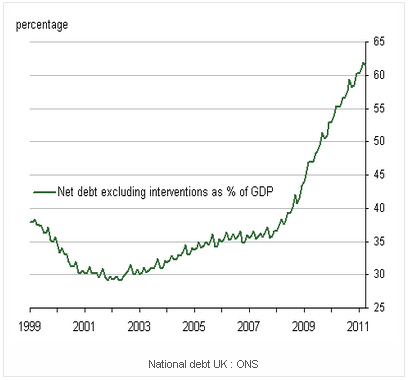

The Politicians won't tell you 'what it's really like'. Here we pull together the pertinent facts and the real drivers for the economy. For instance, at the end of 2014 the national debt will have risen to around £1.3 trillion - that's about the same as the size of our whole economy (GDP) in 2010. This takes into account the present governments proposed cuts. What you hear from the Politicians & Media is just the increase for the year, not the total - they don't want you to know.

Add to this the 'hole' in the UK's pension fund for future public sector pensions of another £1.3 trillion.

This equates to around £100,000 for every household in the UK. Your pensions have already been 'invested' in this debt, so in practical terms the pensions don't exist - they exist only as a promise to pay in the future by the government of the day, and this can only come from taxation - in other words we owe the debt to ourselves. (See Debt Fact File)

To create the future wealth that is needed to pay for the interest on this debt along ongoing necessities such as health, education, pensions, importation of energy and food - there must be radical improvement in every sector - the economy, education, the infrastructure & governance - to create a new vibrant Britain providing 21st century success.

TIME FOR CHANGE

Strengths & Weaknesses of 25 Year Planning

Education - for a successful life - in a successful Britain

How long will

Capitalism Reign?

The World View

Good business people understand marginal costing. It is often central to creating long term profitability and investment in the right areas. It applies equally well to the overall economy, after all, this is similar to a complex business.

Consider what this means practically. We have many basic costs within the society, borne by the society. These are the cost for the running of our infrastructure (roads, rail, etc). They are the cost for health, schooling and basic welfare. Unless the society significantly 'fails' in all or some areas, the society will continue to bear these costs.

So when we talk about cutting costs, we really mean just trimming some of these basic costs. It is impossible to cut them substantially unless the society fails to provide for the basic provisions.

These overall costs are made up of both 'fixed' and 'marginal' costs. The fixed costs are not changed by the numbers of people who use the 'service'. For instance the costs of owning and running a hospital are mainly fixed - the buildings, land, heating, administration and basic staffing are all fixed. The marginal costs are usually smaller and increase directly and in rough proportion to the number of patients, such as cost of drugs, laundry, and some additional staffing.

Trimming fixed costs is fine - provided that the cuts do not impact on the societies ability to create future wealth, or just move the costs to another area. (eg from welfare to health and policing).

So what about the marginal costs? Well, since the basic 'fixed cost' are 'fixed' this tells us we need to concentrate on the marginal costs within the society. These are the costs that can be reduced if we change the way Britain works. Big chunks of our overall costs are marginal - and we know they increase directly with the numbers of people who impact them.

Some examples:

a) Poor educational standards - increase costs for welfare, housing and policing.

b) Drug missuse - increase costs for welfare, policing and health

c) High unemployment - increase costs for welfare, policing and health

CST reforms are designed to tackle and thus reduce these marginal costs - the only ones that can sensibly be changed - but the current political parties do not understand the difference between fixed and marginal costs and therefore cannot create a way forward that has any chance of success. So what can we do:

1) Increase efficiency (make more, and do more with the same people, in the same time)

2) Buy less and sell more (specifically imports vs exports)

3) Invest in improvements that cut these marginal costs in the longer term

This is, of course, simple business accounting - but it applies equally well to 'UK Plc'. We don't necessarily need to grow the economy, this will happen due to these changes anyway. 'Going for growth' will just add to future marginal costs. An example of this is to take workers from abroad to grow our economy - whilst this may seem to work initially (as the GDP figures increase), it will add directly to the marginal costs of the UK in the longer term and therefore negate this increase - a good example of chasing your tail. Another example is to put more money into circulation to increase purchasing thereby directly increasing imports.

The other two things that directly influence the future wealth

of Britain are:

1) Exporting more (and importing less)

2) Improving the infrastructure - leading to greater efficiency for the UK as a whole (such as investing in Nuclear and Solar power, along with new transport technologies, to make Britain a net exporter of energy and cheaper overall transport costs)

Interestingly, if the UK spends future money now, (by adding to the debt), on areas such as infrastructure or improved educational processes, this money is mainly kept within the UK and moves from person to person oiling the wheels of UK businesses and the economy as a whole. This is much more effective than growth by increasing high street spending (and thus imports). Raising taxes to pay for investments in reforms is not too silly either - as the money will quite quickly filter back into peoples pockets, (through increased employment for instance), while providing the long term improvement that we seek.

Today, we are facing a growing public debt that will be in the regional of £1.4 Trillion by 2014. It is impossible to cut our basic spending, (fixed costs), by much without damaging the possibility for future success. Unless our politicians begin to understand the difference between fixed and marginal costs within our society and the relevance of long term investment on these costs (and to the overall efficiency of Britain), then we are on a very slippery slope to who knows where?

The arguments must be about 'reforms' and not 'cuts'. If this means in the short to medium term the overall spending is increased, then so what? The fact that the debt is going to reach £1.4 Trillion means that Britain will only be able to manage this debt IF we reform (whilst also increasing our exports). But 'where oh where' are the ideas and detailed plans to help Britain achieve this?... CST

Lets do a thought experiment - if the UK developed the 25 year plan that CST puts forward to improve our infrastructure and create cheap plentiful energy for generations - what would it actually 'cost' Britain? If we ensured that we used existing UK resources, our own scientific research, our own production systems, engineering and building companies, then these costs, while large, would simply flow back into the economy. We would have reduced unemployment, improved science and construction industries. The current government has decided to inflate the economy by £250bn followed by another £75bn. If this 'money (quantitative easing) was used directly to provide such a project, then it would pay for the this huge project - for 'nothing'. And Britain would be left with an ongoing world advantage, very cheap energy and improved transport for many future generations.

Sounds too easy - but we have just spent £325bn on NOTHING! - CST

The last 100 years or so has seen the human race increase it’s overall efficiency of work by some factors of ten. In the last 50 years alone it has quadrupled.

So, what is the problem? Our technologies – everything form energy production, manufacturing, communication, transport, agriculture – have provided massively more efficient ways of doing just about everything. And 50 years ago most modern economies were doing ok, working hard, but surviving mostly with an adequate living.

Commonsense tells us that as technology continues to surge ahead, creating further efficiencies, the world should continue to turn, not just ok but with increasing prosperity. China, India, et al are moving into this modern world, and of course they push up the ‘price’ of commodities as they seek their fair share. But why should our own societies not continue to benefit from the overall increasing efficiency? What are the possible issues that are causing us so much concern?

The only issue that is ‘unsolvable’, as such, is that of the ageing population. And, in a way it is what the human race has striven for over many long years. Our ancestors would not understand our reticence. So, it becomes more imperative than ever to make sure we, as modern societies, can leverage the efficiencies that our forbears have provided. This will enable our societies to create enough wealth for both the young and the old.

Reliance and dogma along with current economic and political models keeps us from examining and seeking new ways to solve these issues. First, our societies need to agree that we do not understand why our political and economic systems are not working for the majority of the people. Secondly, we need to be bold and try different (well thought out) strategies.

CST has already looked at some of the ways we can attempt to move ahead and break the log-jam. CST believes a fundamental change in our thinking is to move away from the pervasive ‘growing’ our economies to that of making them more efficient in the longer term. This will change our basic attitudes towards-

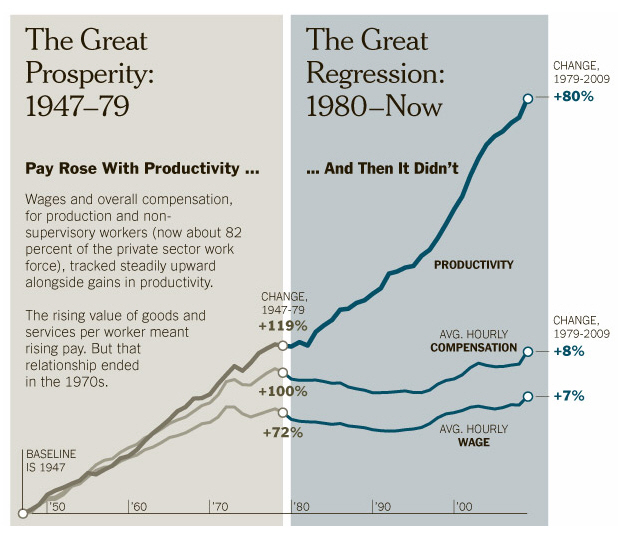

The graph below shows this better than words can ever manage:-